State payroll calculator

Ad Process Payroll Faster Easier With ADP Payroll. Free Unbiased Reviews Top Picks.

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

Get Started With ADP Payroll.

. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Paycheck Calculator California State Controllers Office. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Free Unbiased Reviews Top Picks. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Determine your taxable income by deducting pre-tax contributions.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Compare This Years Top 5 Free Payroll Software.

Ad Process Payroll Faster Easier With ADP Payroll. Federal Salary Paycheck Calculator. However federal income and FICA Federal Insurance Contribution Act taxes are unavoidable no matter where you work.

Please enter the following information to calculate your net pay. Indiana Salary Paycheck Calculator. Just enter the wages tax withholdings and other information required.

Ad Compare This Years Top 5 Free Payroll Software. California government employees who withhold federal income tax. Get Started With ADP Payroll.

Use our free check stub maker with calculator to generate pay stubs online instantly. State Employees News and Information Facts and Programs Payroll Officers News and Information Deduction Schedules FAQ General Information Payroll Schedules Salary Scales. Use ADPs New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

The state tax year is also 12 months but it differs from state to state. Federal payroll tax rates for 2022 are. Fast and basic estimates of Fed State.

Washington state does not impose a state income tax. A paycheck calculator allows you to quickly and accurately calculate take-home pay. Paycheck Calculator Download.

17 rows The State Controllers Office has updated the Employee Action Request STD. 686 form to reflect the redesign. Payroll Calculator ForTax Year 2019.

Please note that any information not entered will be considered 0. The rates have gone up over time though the rate has been largely unchanged since 1992. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Payroll check calculator is updated for payroll year 2019 and will calculate the net paycheck amount that an employee will receive based on. Lowest price automated accurate. Some states follow the federal tax.

If you have questions about Americans with Disabilities Act. Social Security tax rate. Its a simple four-step process.

Try paystub maker and get first pay stub for free easily in 1-2-3 steps.

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Gross Pay And Net Pay What S The Difference Paycheckcity

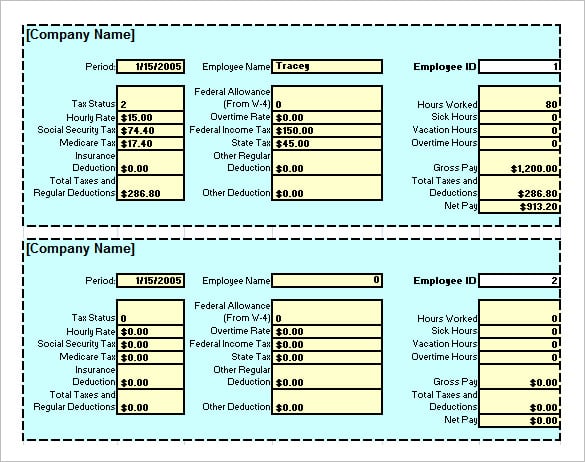

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator Take Home Pay Calculator

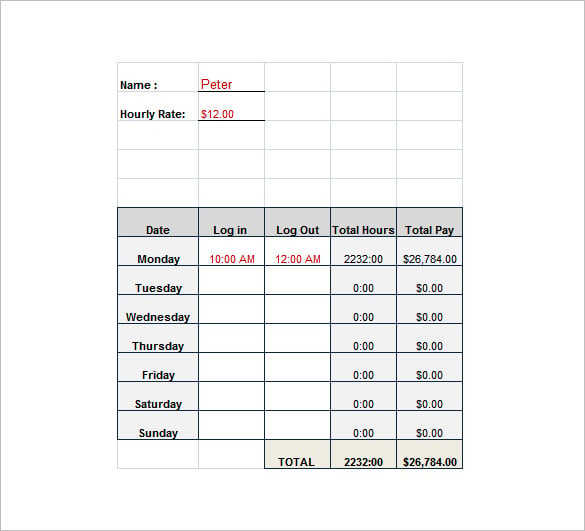

Hourly Paycheck Calculator Step By Step With Examples

Payroll Calculator With Pay Stubs For Excel

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Payroll Calculator Free Employee Payroll Template For Excel

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Paycheck Calculator Online For Per Pay Period Create W 4

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates