Payroll calculator hawaii

Counties and cities can charge an additional local sales tax of up to 125 for a maximum possible combined sales tax of 81. These tax tables are then amongst other things used to calculate tax and associated payroll deductions.

Payroll Tax Calculator For Employers Gusto

Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets.

. Groceries and prescription drugs are exempt from the Nevada sales tax. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Dont want to calculate this by hand. The Nevada state sales tax rate is 685 and the average NV sales tax after local surtaxes is 794. Start Free Trial Log-In See Video.

Oregon Paycheck Calculator Calculate your take home pay after federal Oregon taxes Updated for 2022 tax year on Aug 02 2022. You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year. This number is the gross pay per pay period.

Find out how easy it is to manage your payroll today. Small Business Low-Priced Payroll Service. Dont want to calculate this by hand.

202223 Tax Refund Calculator. There is no state-level payroll tax. Subtract any deductions and payroll taxes from the gross pay to get net pay.

This number is the gross pay per pay period. HI Hawaii State Salary Comparison Calculator 2022 ID Idaho State Salary Comparison Calculator 2022 IL. Subtract any deductions and payroll taxes from the gross pay to get net pay.

The PaycheckCity salary calculator will do the calculating for you. State and local income tax rates. Payroll management made easy.

Starting as Low as 6Month. Nevada has 249 special sales tax jurisdictions with local sales taxes in. The changes to the tax tables can be long and often contain information that whilst important is not relevent to the majority.

3 Months Free Trial. Refer to Tax Foundation for more. The PaycheckCity salary calculator will do the calculating for you.

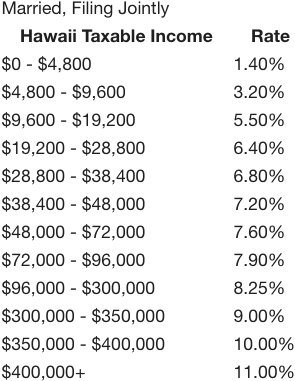

Each filer type has different progressive tax rates. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Employer Payroll Tax Calculator Incfile Com

How To Do Payroll In Excel In 7 Steps Free Template

Hawaii Wage Calculator Minimum Wage Org

How To Do Payroll In Excel In 7 Steps Free Template

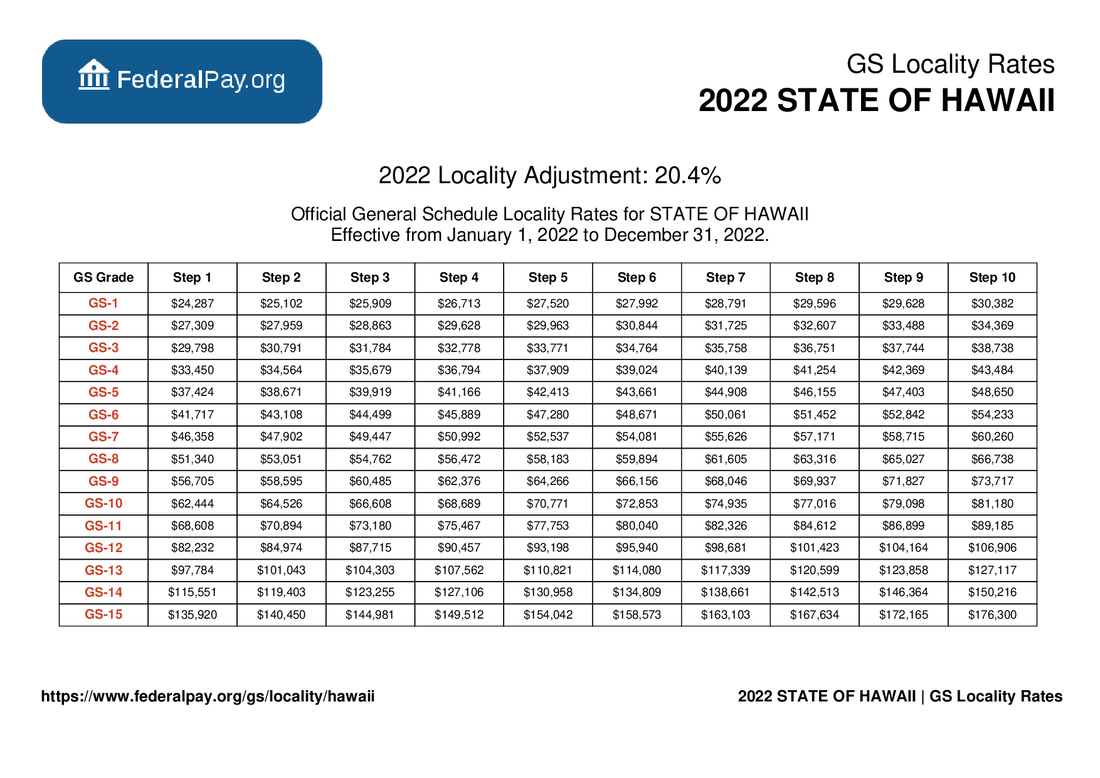

Hawaii Pay Locality General Schedule Pay Areas

Hawaii Paycheck Calculator Smartasset

Equivalent Salary Calculator By City Neil Kakkar

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

County Surcharge On General Excise And Use Tax Department Of Taxation

Hawaii Paycheck Calculator Adp

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Hawaii Paycheck Calculator Adp

Calculating Payroll For Employees Everything Employers Need To Know

Gross Pay And Net Pay What S The Difference Paycheckcity

Hawaii Paycheck Calculator Smartasset

Cost Of Living In Hawaii In 2020 The Ultimate Guide To The Price Of Paradise

How To Do Payroll In Excel In 7 Steps Free Template